The Asia-Pacific (APAC) region, which includes several of the world’s fastest-growing economies, performed strongly in the first quarter of 2024. This led to an increase in the market capitalization (MCap) of companies within the region. China moving away from lockdowns, strong domestic demand in India and Indonesia, and better-than-expected corporate earnings across the region led to an increase in the aggregate MCap of the top 50 APAC companies by $651.1 billion, reveals GlobalData, a leading data and analytics company.

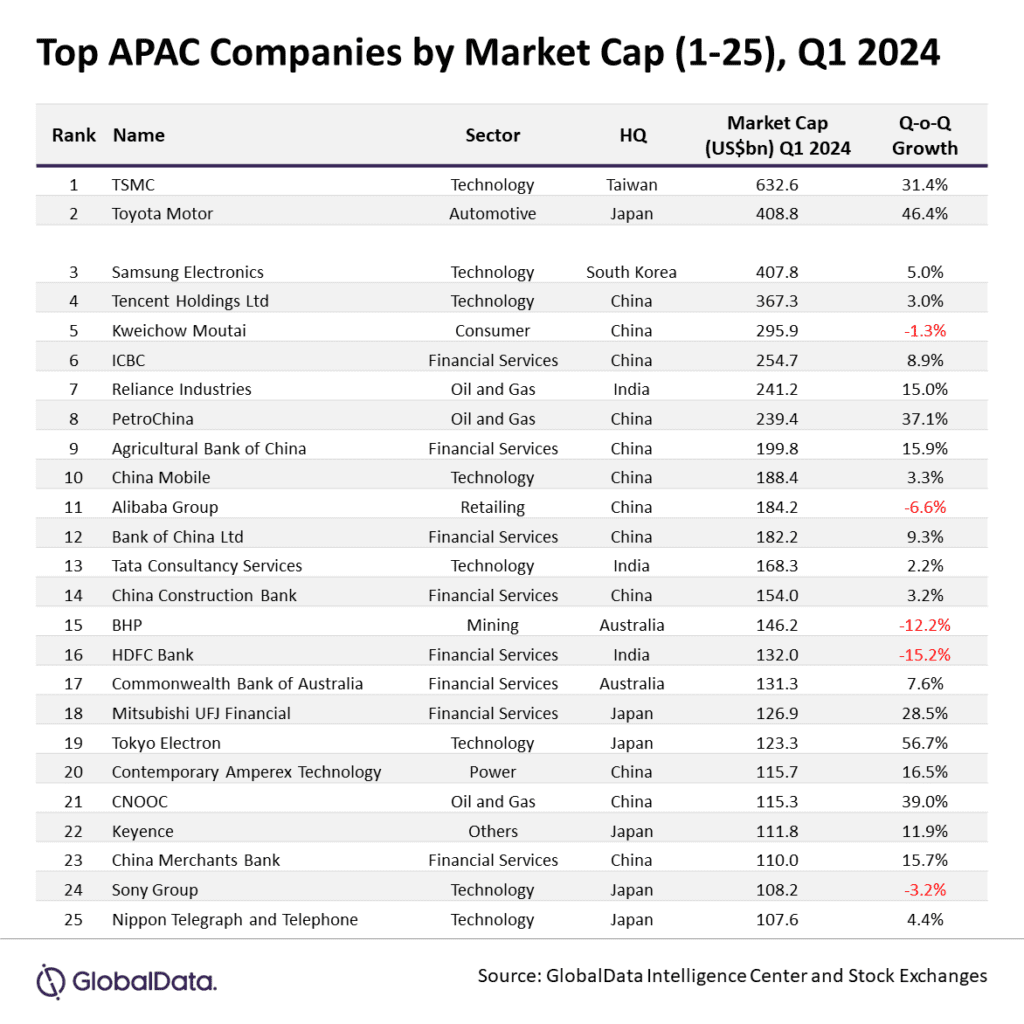

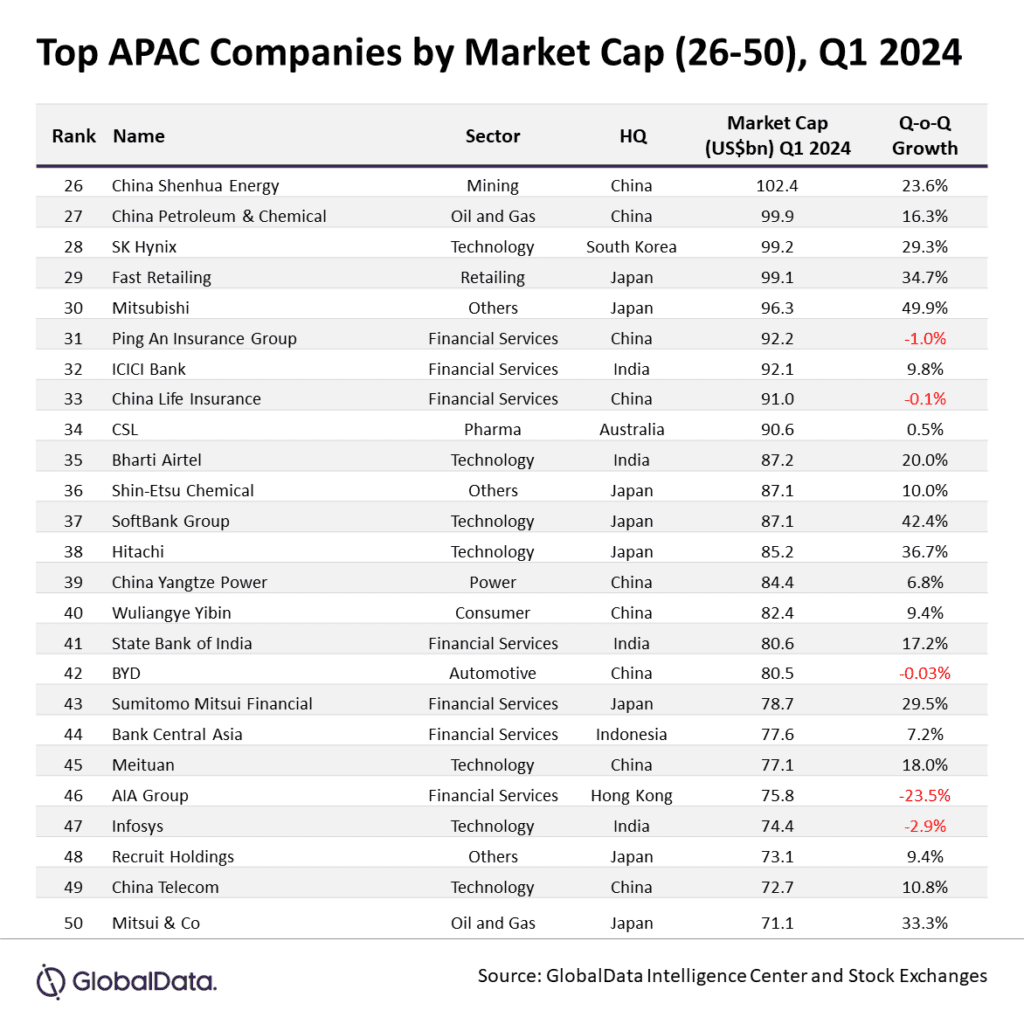

Among the top 50 companies, 15 each belonged to the technology and financial services sectors. In terms of geographic distribution, 21 of these leading companies were based in China, 14 in Japan, and seven in India. At the end of the first quarter of 2024, the combined market value of companies in the technology sector reached $2.7 trillion, while those in the financial services sector totaled $1.9 trillion.

Murthy Grandhi, Company Profiles Analyst at GlobalData, comments: “Japanese stocks witnessed a bull run in the first quarter of 2024, fueled by the Bank of Japan’s historic shift from negative interest rates from -0.1% to a range of 0%-0.1%, its first increase since 2007. The move, which is aimed at boosting growth and export competitiveness through a weaker yen, has made Japanese stocks more attractive to investors, particularly given China’s post-pandemic struggles and real estate woes. Japan’s faster adoption of technologies such as artificial intelligence (AI), alongside new policies aimed at improving shareholder returns through dividends and buybacks, further bolstered its market appeal. However, demographic challenges such as an aging population and low birth rates may still present challenges in sustaining this economic momentum.”

Players that witnessed significant gains include Tokyo Electron, a chipmaking equipment manufacturer, which experienced more than 50% quarter-on-quarter (QoQ) growth in its market capitalization, riding on the excitement surrounding Nvidia and AI. Its AI server-related business is emerging as a key growth catalyst. Furthermore, investments in advanced DRAM memory are poised to drive the recovery of the chipmaking equipment market.

Mitsubishi Corp‘s market valuation surged by over 49.9% in the quarter, due to the announcement of a share buyback program and quarterly results that exceeded expectations. Japanese auto major Toyota Motor witnessed a 46% gain in MCap, benefiting from a weaker currency.

Grandhi adds: “The Chinese constituents in the top 50 APAC companies list witnessed a 7.6% increase in market value, driven by a revival in production activities following the Spring Festival and various government initiatives focused on stabilizing economic growth and improving public welfare. Oil majors CNOOC and PetroChina experienced market capitalization gain of 39% and 37.1%, respectively, buoyed by continued surge in oil prices and positive annual results for 2023.”

Constituents that experienced a significant loss in their market value include AIA Group, which suffered a 23.5% decline in its MCap, even though it reported positive results for 2023. This decline can be attributed to fluctuations in the overall Hang Seng index and the absence of significant buyback announcements.

The market capitalization of Indian banking major HDFC Bank also experienced a fall by 15.2% to $132 billion from the previous quarter. The decline was mainly linked to merger-related challenges, increased operating costs, and reduced yields due to higher home loan volumes at HDFC Ltd.

Grandhi concludes: “The performance outlook for APAC companies in the subsequent quarters of 2024 suggests a varied picture. Interest in Chinese stocks is on the rise, driven by optimism for economic recovery, though emerging markets are still not keeping pace with their developed counterparts. In response to challenges in the property sector, China’s central bank has cut interest rates and plans to buy treasury bonds to boost liquidity. Despite these efforts, ongoing geopolitical tensions pose a significant risk, which previously led to a decline in performance during the first quarter after a stretch of negative returns. In contrast, India demonstrates bullish market sentiment, underpinned by strong corporate earnings and political stability. The country’s growing population, now exceeding China’s, is expected to be a key driver of economic growth and, consequently, stock market gains. This dichotomy highlights the complex dynamics shaping APAC’s investment landscape in the near term.”

Read next: Brand value surge propels NVIDIA to the top spot in the semiconductor industry