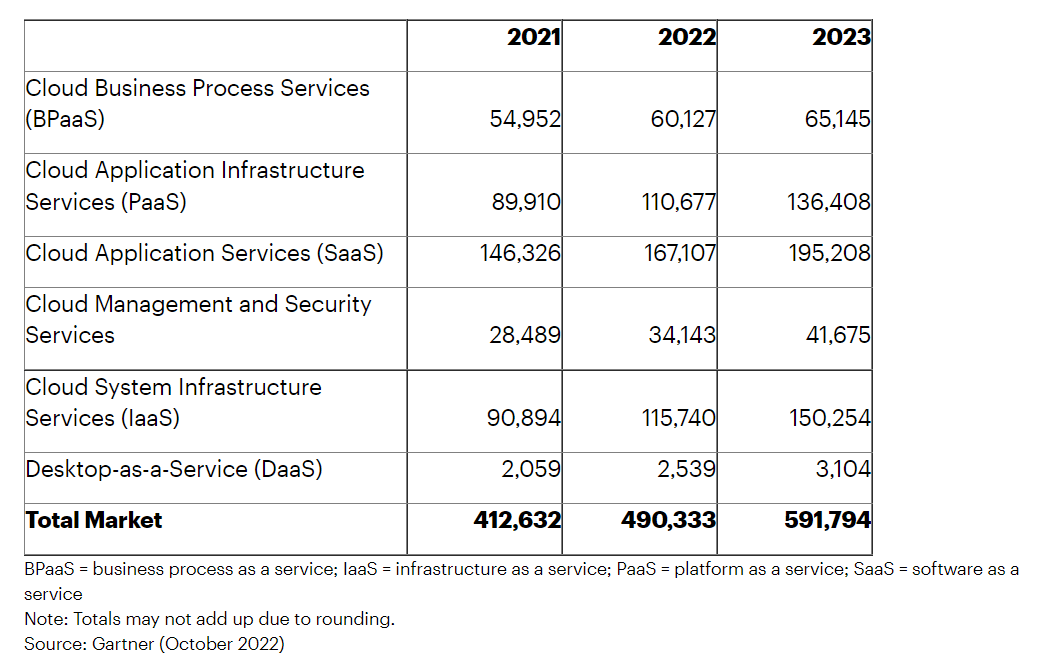

According to the latest forecast from Gartner, Inc., spending on public cloud services worldwide will grow 20.7% to a total of $591.8 billion by 2023. This is higher than the growth forecast for 2022 which was 18.8%.

The current inflationary pressures and macroeconomic conditions are affecting how much organizations spend on cloud computing. Cloud computing is still a safe and innovative way to grow during uncertain times, but organizations can only spend what they have. If overall IT budgets shrink, then the amount of money organizations spend on cloud computing may decrease.

IaaS to witness the highest growth

Infrastructure-as-a-service (IaaS) will see the highest end-user spending growth in 2023 at 29.8%. As businesses continue to modernize their IT operations, many will turn to IaaS as a way to reduce risk and optimize costs. Moving to the cloud allows companies to spread the cost of their operations over a longer period of time, which can be critical in difficult economic times.

Global public cloud services end-user spending forecast (millions of U.S. Dollars)

According to Gartner, Platform-as-a-service (PaaS) and software-as-a-service (SaaS) will be impacted by inflation the most due to staffing challenges and the focus on margin protection. However, Gartner predicts 23.2% growth for PaaS and 16.8% for SaaS in 2023.

AWS, Azure, and Google cloud account for 72% of the public cloud market

According to Synergy Research Group, the total revenue from cloud infrastructure services (including IaaS, PaaS, and hosted private cloud services) in Q3 2022 was $57.5 billion. This brings the total revenue for the past twelve months to $217 billion. The market for public cloud services, which includes IaaS and PaaS, is growing quickly. In Q3 2022, it grew by 26%. The major providers of these services – AWS, Azure, and Google – have a very large market share. They control 72% of the market for public cloud services.

In the third quarter of 2022, enterprise spending on cloud infrastructure services crossed $57 billion with year-on-year growth of 24%. This increase in cloud spending is well over $11 billion from Q3 2021.

Read next: 3 trends favoring North America data center liquid cooling market forecast