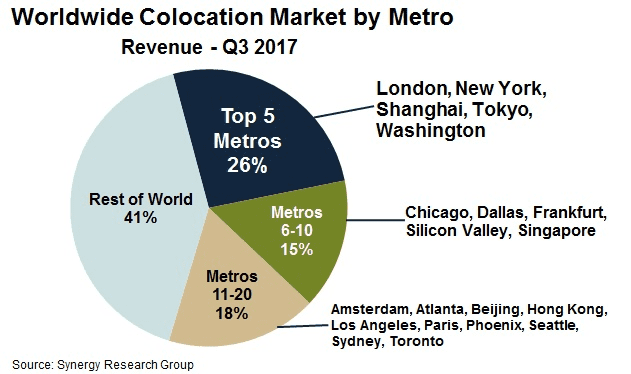

As per the data from Synergy Research Group, 59% of the global retail and wholesale colocation revenues came from just 20 metro cities.

Of these 20 metro cities, ten are in North America, four in EMEA, and six in APAC region. As per the findings, top 5 of them (Washington, New York, Tokyo, London, and Shanghai) alone accounted for around 26%, while remaining 15 metros accounted for 33% of the total market.

During 2017, the colocation revenue growth in top 5 metros was 2%more compared to rest of the world (RoW). Shanghai, Beijing, Hong Kong, and Washington saw over 15% annual growth, where growth in wholesale was higher. Chicago saw rapid growth in wholesale but fell weaker in retail colocation.

Individually, during Q3 of 2017, retail colocation seized 72%, while wholesale seized 28% of Q3 revenues. Equinix dominated the market by revenue during the quarter, leading eight of the top 20 metros. Digital Realty is predicted to dominate five more Metros, if a full quarter of acquired DuPont Fabros operations were included in its members, the report stated.

“While we are seeing reasonably robust growth across all major metros and market segments, one number that jumps out is the wholesale growth rate in the Washington/Northern Virginia metro area,” said John Dinsdale, a Chief Analyst and Research Director at Synergy Research Group. “It is by far the largest wholesale market in the world and for it to be growing at 20% is particularly noteworthy. The broader picture is that data center outsourcing and cloud services continue to drive the colocation market, and the geographic distribution of the world’s corporations is focusing the colocation market on a small number of major metro areas.”

Also read: Hyperscale data-center count will soon touch 400-mark: Synergy Research

21Vianet, @Tokyo, China Telecom, CoreSite, CyrusOne, Global Switch, Interxion, KDDI, NTT, SingTel and QTS, were the colocation operators to lead in the top 20 metros.