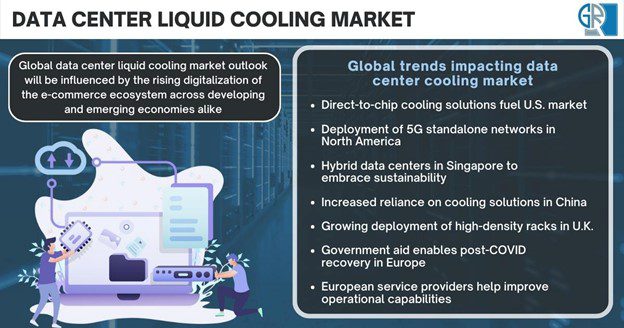

According to a recent study from market research firm Graphical Research, the global data center liquid cooling market size is set to register a significant growth during the forecast timeframe, as digitalization of the e-commerce ecosystem is rising across developing and emerging economies alike. Many of the regional immersions cooling specialists, like Iceotope Technologies and GRC (Green Revolution Cooling), have recently secured millions of dollars in funding rounds. During the forecast period, every sector will continue to generate substantial amounts of confidential consumer data. With this rise, the need for better security will exhibit the below-mentioned global trends:

Growing deployment of high-density racks in U.K.

U.K. data center liquid cooling market size will rise at a significant rate during the forthcoming years, as the dependence on high-density racks has been growing. The recent boom in the BFSI and telecommunication applications is leading investors to prioritize the construction of new data centers.

Cloud service providers in the U.K. are deploying the latest cybersecurity solutions, which create a lot of carbon emissions. Because immersion cooling technologies offer smaller footprints and enhanced server dependability, many companies are transitioning to these systems.

Government aid enables post-COVID recovery in Europe

The regional demand for cooling systems declined during 2020 and 2021, however, introduction of favorable government policies in 2021 was a revival phase for the industry players. Supportive government programs across the U.K. and Italy promoted digitalization of numerous industries, leading them to adopt stronger heat management solutions. As more individuals rely on digital payment apps, the data center infrastructure for BFSI applications will enhance product use.

European service providers help improve operational capabilities

The European data center liquid cooling market is growing because regional vendors are providing solutions that help improve customer business operations. These companies have been effective in managing IT devices for their clients. They have also been working closely with their clients to plan and create custom packages that include connectivity, software, and hardware solutions.

Direct-to-chip cooling solutions fuel U.S. market

Large-scale deployment of powerful chips is causing the U.S. data center liquid cooling market share being pushed from the direct-to-chip segment. Increased focus toward digitalization has enhanced the overall computing capacity of data centers and increased the importance of heat management techniques. The efficiency of High-Performance Computing (HPC) and AI applications depends on the use of powerful GPUs, enhancing product demand.

Reduction in energy consumption and total expenditure are some key benefits that accompany these solutions. Several retail and IT companies are seeking ways to reduce their electricity bills to increase their profit margins.

Standalone 5G networks deployment in North America

As numerous telecom service providers across Canada and the U.S. are upgrading their networks to 5G standalone (SA) solutions, it is leading to the growth of data center liquid cooling market size in North America. Recently, in March 2022, Ericsson announced its partnership with Rogers Communications Inc. to cater to the need for advanced 5G network solutions to several industrial verticals in Canada. Such developments put pressure on thermal management of critical IT equipment, which will foster the data center liquid cooling market expansion in the next few years.

Hybrid data centers in Singapore to adopt sustainability

The substantial rise in data center infrastructure has made the rack or row cooling technology has quite popular. Increased use of this technology is expected to enable higher protection of high-density racks, thereby permitting them to be thermally neutral alongside conventional air-cooled room-based systems.

The Singapore government has been collaborating with data centers for testing the use of liquid cooling technologies for hybrid data centers. For example, in June 2021, the regional government partnered with Facebook and raised over $17 million, for addressing the sustainability concerns of data centers in tropical climates.

Increased reliance on cooling solutions in China

With concerns regarding customer data safety growing in the country, China data center liquid cooling market size is increasing year-on-year. The Chinese Cybersecurity Law mandates data localization of all key data center operators within the national borders. This law makes it compulsory for companies to store, process, and analyze critical consumer data on a domestic level.

Increasing number of Chinese companies, including Tencent and Alibaba, have been joining forces to reduce carbon emissions by adopting advanced liquid-cooling systems in their data centers. Lately, in March 2022, Microsoft Azure inaugurated its fifth data center in China for doubling the cloud capacity of Microsoft’s portfolio for multiple industry verticals.

Read next: Data center liquid cooling market to have a phenomenal CAGR of 19.4% in the next 10 years

Nice Post