In the fourth quarter of 2022, enterprise spending on cloud infrastructure services was more than $61 billion worldwide. This is an increase of more than $10 billion from the fourth quarter of last year, but it does show a reduction in the market growth rate. The 21% growth over Q4 of 2021 was again limited by the strong US dollar and the restricted Chinese market, according to Synergy Research. In the third quarter of 2022, enterprise spending on cloud infrastructure services crossed $57 billion with year-on-year growth of 24%.

The growth rate in the US market for the fourth quarter was 27% when compared to an average growth rate of 31% during the previous four quarters. The reduced growth rate was partly expected because of the large market size, and the current economic climate which negatively impacted cloud infrastructure spending.

Microsoft increases market share to 23%

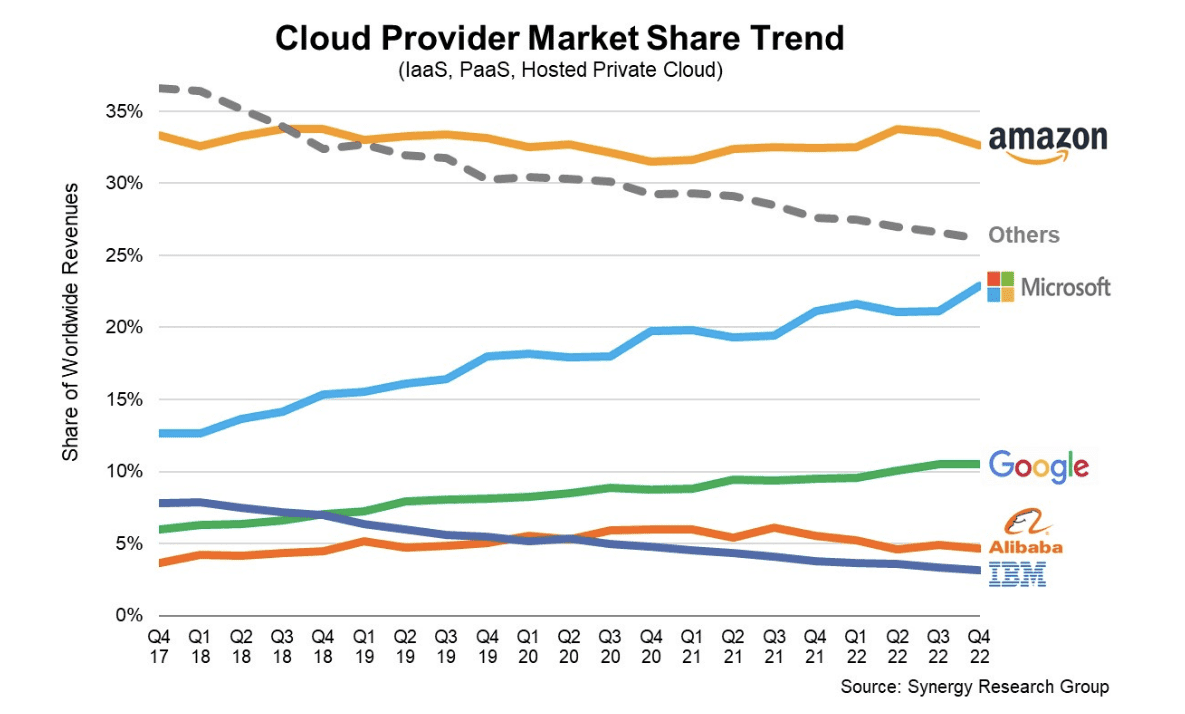

Microsoft’s worldwide market share increased to 23% as compared to an average of 21% in the previous quarter. Meanwhile, Amazon’s market share remained at 32-34%, while Google’s share was 11%. Together, these three companies make up 66% of the worldwide cloud revenue, up from 63% a year ago.

As most cloud providers released their earnings data for Q4, it can be estimated that the providers made a total of $61.6 billion in Q4 by selling cloud infrastructure services. These services include IaaS, PaaS, and hosted private cloud services. In total, the cloud infrastructure spending in the past twelve amounts to $227 billion. Most of this revenue comes from IaaS and PaaS services, which grew by 22% in Q4. The top three providers make up 73% of the market.

The worldwide market for cloud services grew by $47 billion in 2022, which is almost as much as it grew the year before. Synergy predicts that the market will continue to grow strongly in the coming years.

AWS, Azure and Google Cloud revenues are helping their parent companies

Although AWS’ sales only increased 20% from last year, it is still helping Amazon a lot when it comes to overall profitability. AWS grew sales in 2022 much more than Amazon did, with a total annual revenue of $80.1 billion. That is 29% more than what was made in 2021.

Microsoft Cloud revenue was up by 22% reaching $27.1 billion while Microsoft Corporation reported a 2% rise in revenue reaching $52.7 billion. Revenue from Intelligent Cloud reached $21.5 billion increasing by 18%.

Alphabet reported overall gross revenue of $76.05 billion for the fourth quarter of 2022, with a slight 1% increase from last year’s figures. The Google Cloud business segment that did well, earned 32% more revenue than it did last year, bringing in $7.32 billion.

Read next: Cloud security is the top concern for organizations in 2023: PwC’s Digital Trust Insights Survey