As cinema halls take a back seat, there is an unprecedented boom in the OTT Market across the globe due to the pandemic situation. Just like it is with the rest of the world, OTT viewership in India is at an all-time high now. While OTT platforms were making a mark for themselves in the Indian market, the COVID crisis accelerated the process. From just two OTT platform provider in 2012 to about 40 players now, the OTT revolution has come a long way in India.

Assuming the crisis is not going to get over anytime soon, here is a brief outlook on what could be the future of OTT in India:

-

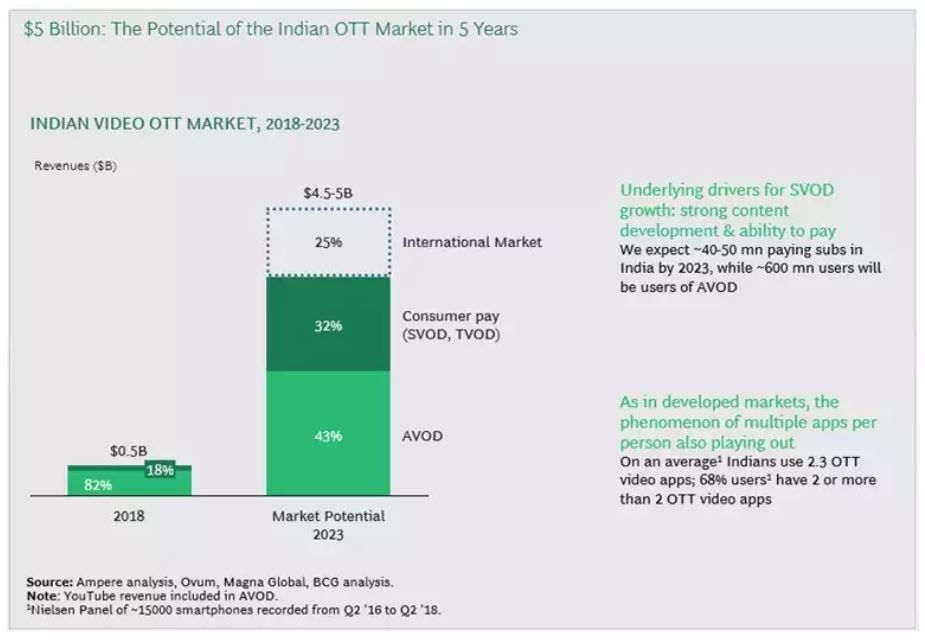

Market size USD 5 bn by 2023: A Boston Consulting Group report predicts that the OTT content market is at an inflection point in India and is like to reach $ 5 bn in size by 2023. An increase in disposable income, internet penetration to rural markets, and OTT video adoption across demographic segments have been the key drivers of OTT market growth in India.

The majority of Indian households have a single TV per household. However, as part of the Digital India plan, the government has been investing in high-speed broadband enterprises to amplify broadband coverage and adoption which is crucial for OTT video success. Therefore, the availability of affordable data has created an alternate medium where consumers, can tap into any content, any time, at any place on a device of their choice as per their convenience. With the necessary infrastructure being put in place it is but obvious the sector will grow at this pace.

- Rural India is opening a new distribution channel: With increased internet penetration in the rural areas (estimated to be ~650 mn by 2023), OTT players are keen on developing regional content to cater to the rural markets. As per Nachiket Pantvaidya, CEO, ALTBalaji and Group COO, Balaji Telefilms, lack of other entertainment options has spurred audiences (mostly from Tier2 & Tier 3 cities) who had not discovered OTT viewing up until the pandemic struck are adapting to these platforms. While most of them are first-time samplers, as the lockdown will still, platform owners are trying to increase customer stickiness by bringing in a variety of content to cater to the increased content viewing appetites. Also, before the pandemic started the top 8 cities in India contributed to 70% of the total audience for Alt Balaji. However, post-April 2020 the scales have turned to 40-60, where 60% of the traffic is from outside the top 8 cities.

-

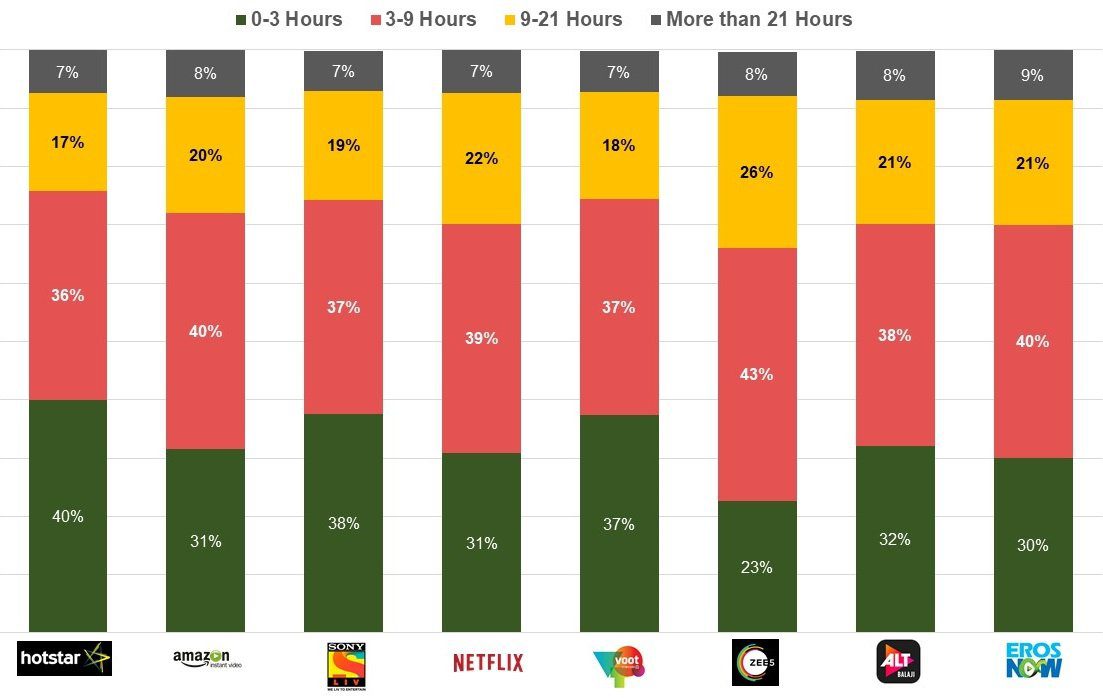

Production houses are going digital: Due to the pandemic situation, the average time spent by Indian OTT subscribers has increased from around 20 mins to 50 minutes to 1 hour in current times. While there were only 2 OTT platforms in 2012, now there are approximately 40 platforms catering to subscribers in India. About 49% of India’s youth spend 2-3 hours watching content online. With this rate of consumption, it is obvious that the content pipeline will perish is no time with an audience hungry for more content. To keep up with the growing demand for more content, OTT behemoth Netflix is planning to spend INR 3000 crore to create content in the Indian context. At the same time, production houses with immense production experience, knowledge about what content consumers prefer are venturing from linear TV to OTT. Many production houses have already made the collection of their content available for platforms like YouTube. Most of them have already started reaching out to other rising OTT platforms of preference in India such as Hotstar, Sony LIV, Hoichoi, Eros Now, and Sun NXT. In fact, according to a Counterpoint Technology survey, it has been found that Hotstar is the most popular OTT platform in India.

Source: India OTT Video Content Market SurveySoon theatres will become experience centers known mostly for their exclusivity soon as audiences will be able to watch quality content both old and new, at a fraction of the cost in the comfort of their homes.

- OTT subscriptions have become the latest weapons in India’s Telecom war: India’s telecom price war is back after a hiatus and the battle is being fought on freebies. At Rs 6.7 ($0.09) per gigabyte (GB), the average cost of mobile data in India is the cheapest in the world, according to the Worldwide Mobile Data Pricing report for 2020 by UK-based Price comparison firm Cable.co.uk. With the proliferation of smartphones and the availability of internet connectivity at a cheaper rate coupled with extended lockdowns and its repercussions, OTT seems to be the next normal in the world of entertainment. Therefore, telecom carriers are offering incentives such as subscriptions to services from Netflix to Amazon Prime to win customers in a content-hungry market. India’s biggest telecom company by virtue of the number of subscribers, Reliance Jio Infocomm ltd. Has announced a new 399–rupee plan for postpaid users. Besides 75 GB of data, customers get access to Netflix on a mobile device, a one-year subscription to two OTT applications, and access to Jio’s movies and songs. These are some instances to show that the Indian customer is spoilt for choice.

-

An explosion in kids’ education & entertainment (edutainment) options: Stories have been the building blocks of our childhood days. India is one of the oldest living cultures and abounds in stories that delve into morality, philosophy, sociology, fantasy, etc. In this digital age, stories are molded into new formats to suit the modern palette and shape a whole new generation. According to a 2019 PricewaterhouseCoopers report, in 2018, more than 40% of new internet users in the world were children. Around 1,70,000 kids get online daily.

Broadcasters in the kids’ entertainment space are making the most of this shifting content consumption patterns to create India-inspired characters and storylines that resonate with today’s young audiences. In a 2019 report by Broadcast Audience Research Council (BARC) India, the share of localized content across national kids’ entertainment channels detailed an increase from 33% in 2016 to 39% in 2018. There is a huge market in the kid’s genre and along with the international players like POGO, Cartoon Network, Discovery Kids, homegrown Indian brands like VOOT kids, Hungama Kids, Zee5 Kids are fighting for a share of the market. In the field of kid’s education, owing to shut down and indefinite closure of schools, a Bobble.AI report states that Edtech platforms such as Udemy, Unacademy, and Byjus, which have posted an 82.73% increase in time spent, along with a 122.62% increase in engagement and 25.12% increase in DAU’s. Udemy has seen a 119.05% increase in time spent, with a 36.93% increase in engagement.

-

Application of OTT in Corporate e-Learning: From Classroom-Based Learning (CBL) to a more flexible, informal, and collaborative process, the process of learning has evolved over time. The global LMS market size is expected to grow from USD 13.4 billion in 2020 to USD 25.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period. Increase in adoption of digital learning, corporates’ inclination towards Bring Your Own Device (BYOD) policy and enterprise mobility, widespread government initiatives for the growth of LMS, application of Artificial Intelligence (AI) and Machine Learning (ML) in LMS is increasing the significance of eLearning in corporate and academic setups. At a time when physically attending training is a distant idea, organizations can meet their learning objectives by incorporating a corporate e-learning solution. It empowers organizations to train their remote workforce and enable them for future needs.

On being asked regarding the biggest challenges he is facing in up-skilling people and navigating through these challenges during the pandemic situation, N.K. Mohapatra, CEO of Electronics Sector Skills Council of India (ESSCI) vouched on the efficacy of state-of-the-art Learning Management Systems. Currently, one of the interesting projects under his aegis is where the ESSCI is upskilling and certifying 1,00,000 AC technicians in the best practices and use of environment-friendly gases under the HMPM project in partnership with the ozone Cell under the Ministry of Environment, Forests and Climate Change.In this era of Netflix and YouTube, an efficient Learning Management Solution (LMS) empowers employees with the flexibility to access training at their own will and pace. With features like advanced search and filtering, employees can search and consume relevant materials whenever needed. In addition to the flexibility to learn, gamification in such solutions helps in higher engagement levels and can even help in improving overall retention too.

-

Online gaming has surged during the lockdown: Gaming apps topped the new downloads category on both Android and iOS phones in Q1 of 2020. Online gaming continues to grow even after a stellar 2019. The All India Gaming Federation (AIGF) has mentioned that Online Gaming has grown by 12% during the lockdown. In an interview, Roland Landers, CEO of AIGF said,

“Online skill gaming hasn’t seen any adverse impact since players are participating digitally unlike in physical gaming. Online card games and digital e-sports have seen a higher uptick in the past few weeks as people look for ways to pass time indoors. The volume of data going towards online gaming is also growing and will continue to grow if this situation persists.”

Especially around the younger population and the conducive environment, gaming could emerge to be a major beneficiary of the overall digital ecosystem. Media companies and OTT providers especially can look at adding gaming as a potent extension to their ecosystem offerings.

- Fitness industry seeks virtual presence via OTT: Gyms in India closed when the lockdown restrictions were strictly levied. According to a Bobble.AI report, besides video conferencing apps, and websites, fitness applications such as Lose Weight, Cure.fit, recorded a 104.53% rise in daily active users (DAUs) with engagement rate increasing by 14.72% and time spent on the app increasing by 39.50%. Video streaming platforms having got an opportunity to expand their offerings into genres like health & fitness have entered into strategic alliances to cater to the increased demand and emerging audience segments. For instance, Disney+ Hotstar has partnered with Brilliant Wellness, a fitness, yoga, and nutrition content producer to introduce content curated from its fitness experts, yoga, and spiritual gurus, along with celebrity nutritionists spread across 100 programs. Start-ups like Sarva and CultFit, also brought their workout models on to the video streaming service. VOOT, the VoD platform owned by Viacom18 Media Pvt Ltd, has associated with Cult.fit and ZEE5 has collaborated with Dabur Honey to launch a chat show – Dabur Honey Hello Fitness besides a range of fitness programs in partnership with its live events vertical ZEE LIVE.

- Redefining Sports through OTT: Sports content has traditionally been the largest contributor to the revenues for all Pay-TV services. The disruption of sports broadcasting due to Covid-19 has led to significant erosion of revenue for operators and Pay-TV providers. Yet at a time, when social distancing norms have disrupted live sports, Star & Disney India in the form of Disney+Hotstar VIP have given great joy to a cricket crazy nation. Thanks to this initiative, fans of the Indian Premier League can now join a virtual community that will allow them to enjoy the matches with their friends and fellow cricket aficionados in real-time. To make even more interactive they can share selfies and videos during this year’s Dream11 Indian Premier League.

OTT platforms have helped keep the sanity intact in these difficult times by being a major source of entertainment. Almost every streaming service under the sun is offering free trials and consumers are lapping up the trials. However, the real test is customer retention achieved not just with great content but also great technology. To provide a seamless experience for content viewing, OTT providers need to adopt technology in all the phases of the OTT subscriber’s lifecycle, and it starts with content discovery. Application of AI & ML will help personalize the search experience by understanding the customer psyche and offering the right content at the right time.

References:

- https://www.marketsandmarkets.com/Market-Reports/learning-management-systems-market-1266.html

- https://www.techmahindra.com/en-in/blog/what-the-future-holds-for-ott-players/

- https://brandequity.economictimes.indiatimes.com/news/media/how-ott-market-will-be-a-game-changer-for-the-film-industry/75658326

- https://www.dacast.com/blog/4-ott-trends-to-watch-2020/

- https://www.businesswire.com/news/home/20200818005479/en/Streamed-Video-Content-Dominates-Media-and-Entertainment-Consumption-in-India-According-to-the-Brightcove-Q2-2020-Global-Video-Index

- https://www.emarketer.com/content/india-time-spent-with-media-2020

- https://inc42.com/buzz/binge-on-datalabs-indias-ott-market-landscape-report-2020/

- https://qz.com/india/1860740/otts-netflix-erosnow-work-around-covid-19-in-india/

- https://www.livemint.com/news/india/streaming-platforms-offer-fitness-spiritual-content-11594196122047.html

- https://www.forbes.com/sites/forbestechcouncil/2020/09/09/ott-technology-censorship-and-the-future/#4d59a4cc7721

(This post was originally published here.)

The post Future of OTT in India appeared first on NASSCOM Community |The Official Community of Indian IT Industry.