Fintech in India has been one of the most disruptive markets for many years, with the trend only accentuating in the pandemic-hit year 2020. 2020 has especially seen the rise of many fintech players in India considering the increasing global interest of transforming industries digitally, including the financial services industry.

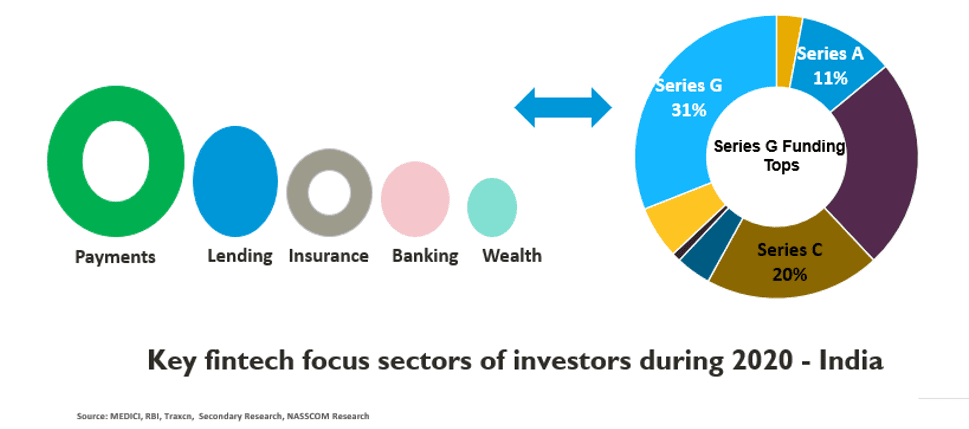

While this led to an overall rise in the VC and PE investments fintech startups rose in India in the year 2020, certain fintech player segments like payments and lending attracted higher funding than the other segments like wealth, and banking, completely owing to the potential disruption these segments promise. Additionally, among the type of funding received, Series G funding topped the chart – hinting that investors are looking to play safe and invest in fintech players with a stable business model.

Some of the prominent fintech investments that transpired in 2020 include but are not limited to:

Razorpay – Razorpay, a payment fintech in India became a unicorn in 2020 after a new $100 million funding round. Razorpay accepts, processes, and disburses money online for small businesses and enterprises.

PineLabs – Pine Labs raised $75-100 million in fresh funding at $2 billion valuation towards the end of the year 2020. PineLabs again is fintech player in the payments domain and the fresh funding is planned to be predominantly deployed in onboarding storefronts across the country onto its ‘Pay Later’ platform.

Turtlemint – Mumbai-based Turtlemint secured $30 million in a round led by GGV Capital. Launched in 2015, Turtlemint is a deep tech platform that helps advisors educate customers and recommend products that are best suited to meet their unique requirements, thereby enabling them to purchase insurance seamlessly.

Mobiwik – Mobiwik, again a payment major fintech player raised INR 415 million as a part of its Series E round from Hindustan Media Ventures. The funding is planned to be used for the Mobiwik Blue American Express Card launch and progression.

Instamojo – Instamojo, other payments fintech player, announced the closing of its Pre-Series-C funding round of an undisclosed sum in the year 2020. The funds raised will be used to expedite the company’s growth and product roadmap as well as venture into international markets in the coming year.

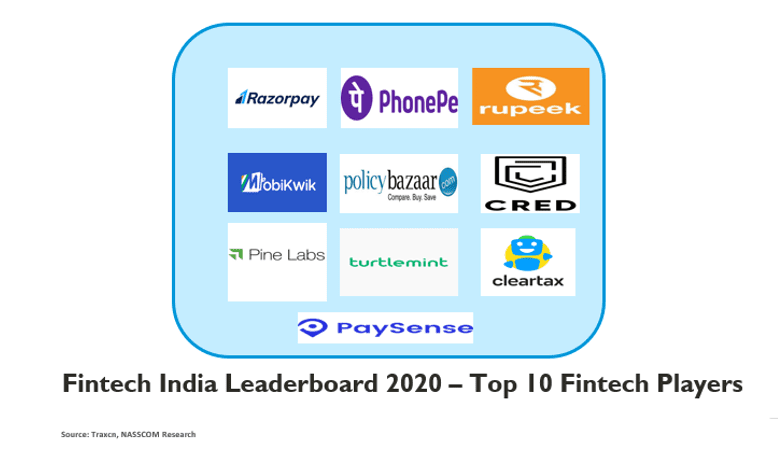

The leaders of the fintech map of India for the year 2020 are hence mainly from the payments domain, followed by the lending and the insurance domain. While the Fintech India Leaderboard 2020 looks obvious, a scored assessment by leading analyst firm Traxcn presents an interesting analysis whereby the 2020 leaderboard of the Indian fintech player market hold the Indian payment fintech, Razorpay at the top of the ladder, followed by other payment fintech players like PhonePe and Mobiwik, including insurance and lending fintech players, Policybazaar and CRED at 5th and 6th place, respectively.

The scored assessment of the leaders of the market is based on metrics like funding received, product launches, enhancements, market scope, etc.

Further, fintech India leaderboard analysis presents some key insights on what worked probably best in the fintech market in India 2020 and what did not work.

What worked in 2020 – Fintech Players Market India?

- The rise in demand for contactless payments and the concurrent rise in the demand for digital payment options from innovative players in the market is something that is clearly seen in the pandemic -hit year 2020, resulting in higher investments in payment fintechs in India

- Digitally first innovative solution offerings for the financial services consumers

- Customized digital solutions for varied types of user groups

- Innovative methods to make the digital financial solutions reach the last mile and even the remote areas of India

- Low-priced solutions and financial products as the consumer spending fell for some months of the year

What did not work in 2020 – Fintech Players Market India?

- Branch-only, physically touch-driven only solutions

- Non-digital customer support

- Huge, bundled, one for all financial products

- Highly prices financial products like insurance policies, loans, etc.

- Legacy systems and laggard approach in building customer solutions

The Way Forward

The Indian fintech market is indeed promising for the year 2021 with a lot more investments likely to come up in fintechs that have a stable business model and a futuristic outlook and look to bring in the digital solutions at the forefront. Further, with the government backing for the Digital India movement and many sandboxes being created by RBI for the growth of digital banking solutions in India, the Fintech market in India is sure to bloom in 2021.

References:

- Indian Fintech Report 2020 MEDICI

- FinTech: The Force of Creative Disruption* – RBI

- Traxcn

- IBS Intelligence

- Secondary Research

- NASSCOM Research

The post Fintech Players India – The Game Changers of 2020 appeared first on NASSCOM Community |The Official Community of Indian IT Industry.