India’s diversified BFSI sector has undergone massive expansion and continues to play a crucial role in driving the Indian economy. With the highest FinTech adoption rate of 87%, which is significantly higher than the global average of 64%, India is the third largest FinTech market globally.

Image source: Datafloq

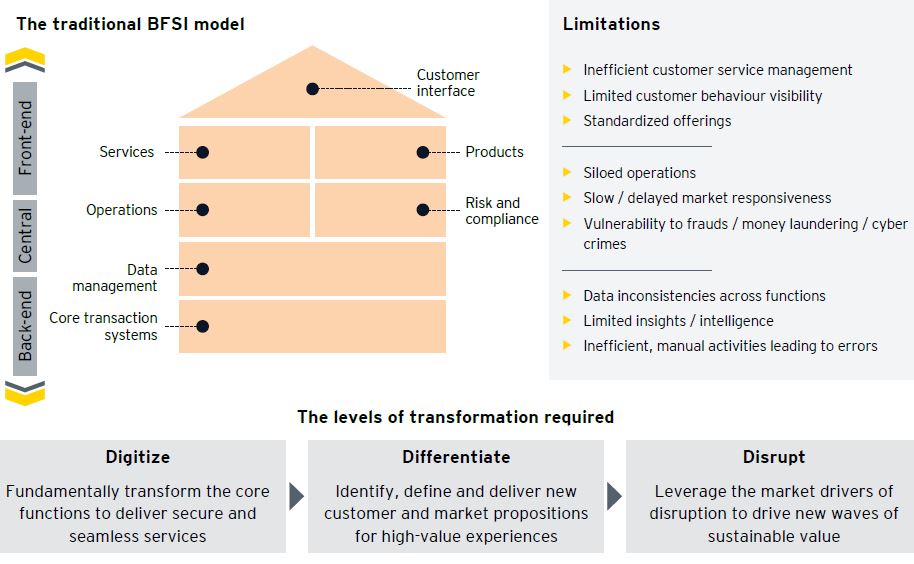

Over the years, traditional Indian BFSI enterprises have relied heavily on in-person, physical establishments and cash transactions. As a result, more manual operations to manage costs – a method that in the increasingly contactless economy is now gradually becoming irrelevant, rigid and non-scalable. The traditional BFSI model faced several limitations across back-end, central and front-end operations. Common challenges being limited customer behaviour visibility, siloed operations and limited insights/intelligence. The traditional models required multiple levels of transformation to be able to seamlessly function and deliver in the future.

As the sector continues to expand and increase its coverage across India, it is also responding to rapidly evolving customer centricity demands, thereby requiring a swift move to digitize internal processes, operations and customer services.

With growing awareness about the transformative potential of AI, BFSI leaders are now realizing the need for developing a strong digital footprint – a key enabler for AI. As a result, leading Indian BFSI enterprises are now placing a higher priority on legacy modernization (with 23% of IT spend for digitization) and BFSI models of the future. While the BFSI enterprises are in their journey to digitize, differentiate and disrupt, COVID-19 has had a significant impact on the sector aggravating certain challenges.

Photo sources used in the graphic: DigiPay.Guru, Forbes, MortgageOrb

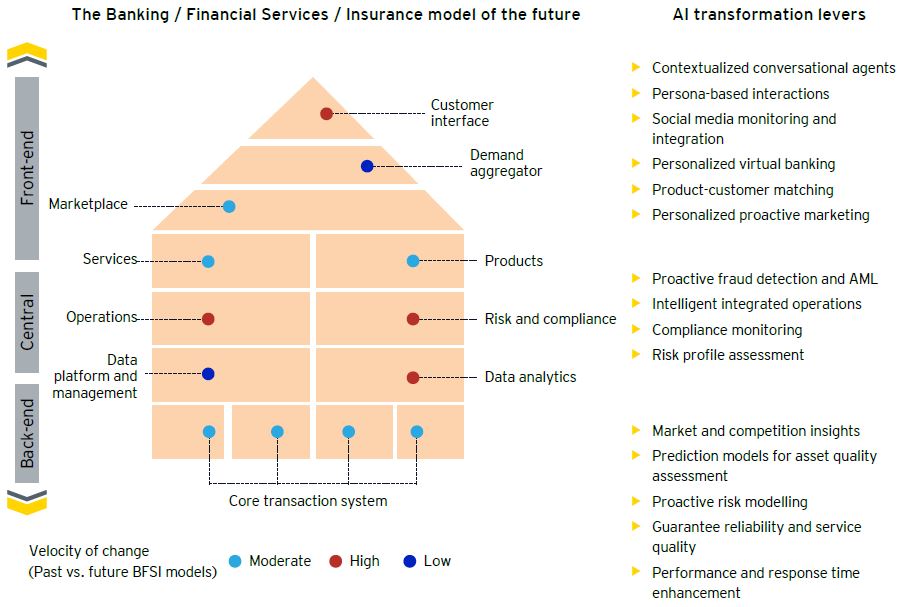

BFSI leaders today agree on the transformative potential of AI and are working towards augmenting their digital capabilities with an unprecedented urgency. AI transformation levers will help enterprises overcome existing and COVID-led challenges, accelerating the shift towards BFSI models of future. The transition towards BFSI models of the future requires transformation at all levels – back-end, central and front-end. The velocity of change however varies across key functions. Functions like customer interface, operations, data analytics and risk and compliance are amongst the areas where the velocity of change is expected to be high.

AI enabled bank / FIs are critical to address the emerging risks. From generating insights based on historical patterns and predicting loan defaults / customer churn, to detecting frauds, providing personalized financial recommendations and digitizing the customer interaction, AI is expected to be an integral part of BFSI enterprises’ strategy going forward.

Watch out my next article for AI opportunities in the BFSI space. Download our full report for more details: Indian BFSI – Unlocking the Transformation Potential of AI

The post AI accelerating the shift towards BFSI models of future appeared first on NASSCOM Community |The Official Community of Indian IT Industry.