The global PC market exceeded expectations in the third quarter of 2023, with shipments reaching a total of 68.5 million units, reports the International Data Corporation (IDC). Despite this positive outcome, there was a 7.2% decline compared to the same quarter in 2022.

The performance of the PC market was influenced by various factors. The increased volume was partly attributed to inventory restocking, particularly on the consumer side. Another contributing factor was the effort to address anticipated cost escalations, including expected increases in Indian import duties. Although these duties were later suspended, concerns led to an excess absorption of units by the channel. Additionally, tightened IT budgets resulted in business PC units underperforming against a conservative commercial forecast.

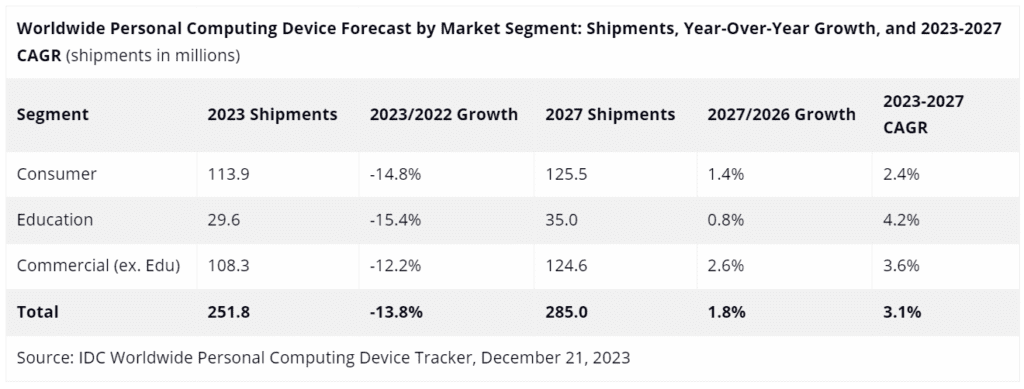

In response to the current conditions and a challenging macroeconomic environment, IDC has revised its forecast for the worldwide PC market.

The expected shipment volume for 2023 is now projected to decline by 13.8% compared to 2022, which itself saw a 16.6% decline from the previous year. This marks an unprecedented trend in the PC market, with two consecutive years of double-digit year-over-year drops.

Despite these short-term challenges, IDC anticipates a market rebound in 2024 and beyond, citing several factors that are expected to drive growth.

One key factor is the PC refresh cycle, with a large and aging installed base of commercial PCs surpassing the four-year mark by 2024. This is expected to necessitate a refresh, coinciding with the demand to migrate toward Windows 11. The total PC market in 2024 is forecasted to experience growth of 3.4% compared to 2023.

Another catalyst for growth is the integration of artificial intelligence (AI) capabilities into PCs. This is anticipated to commence in 2024, initially targeting specific segments of the enterprise PC market. Over time, as use cases advance and costs reduce, the integration of AI is expected to spread to the broader market, driving upgrades.

The continued evolution and recovery of the consumer installed base further contribute to the positive outlook for 2024. The combined impact of these factors positions 2024 as a pivotal year for the PC market, offering a reprieve from recent challenges. Beyond 2024, sustained growth is expected to surpass pre-pandemic shipment levels, culminating in 285 million units by 2027.

Source: IDC