Maxio has released its first Growth Index report that is based on the analysis of anonymized year-over-year customer billing data from the Maxio financial operations platform. The platform handles over $13B in billing and invoicing data each year for its more than 2,000 customers. Most of the company’s clients are VC- or PE-backed software-as-a-service (SaaS) companies generating revenue between $1M and $100M. The Growth Index is a product of the newly launched Maxio Institute, a research and analytics arm of the company. In this article, we will take a closer look at the key findings of the Growth Index report.

According to the Maxio 2023 Growth Index report, B2B software companies are showing impressive resilience despite economic challenges. The report analyzed companies processing $1M or more in annual billings, revealing that 82% experienced year-over-year growth from 2021 to 2022. However, the report also highlights a decline in growth rates for most companies throughout 2022, with a significant drop in December. This trend is believed to be linked to continuing macroeconomic uncertainty and cooling technology markets, as well as increased customer churn around end-of-year renewal dates.

Impact of pricing models on growth rate

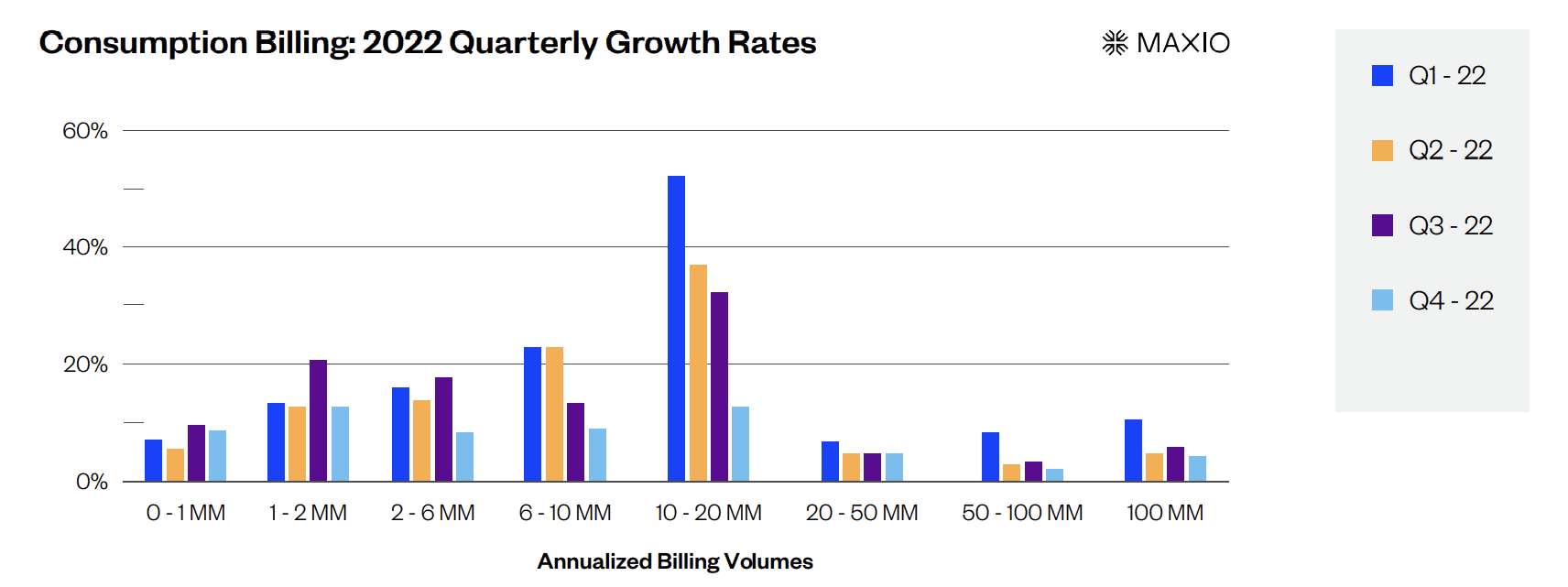

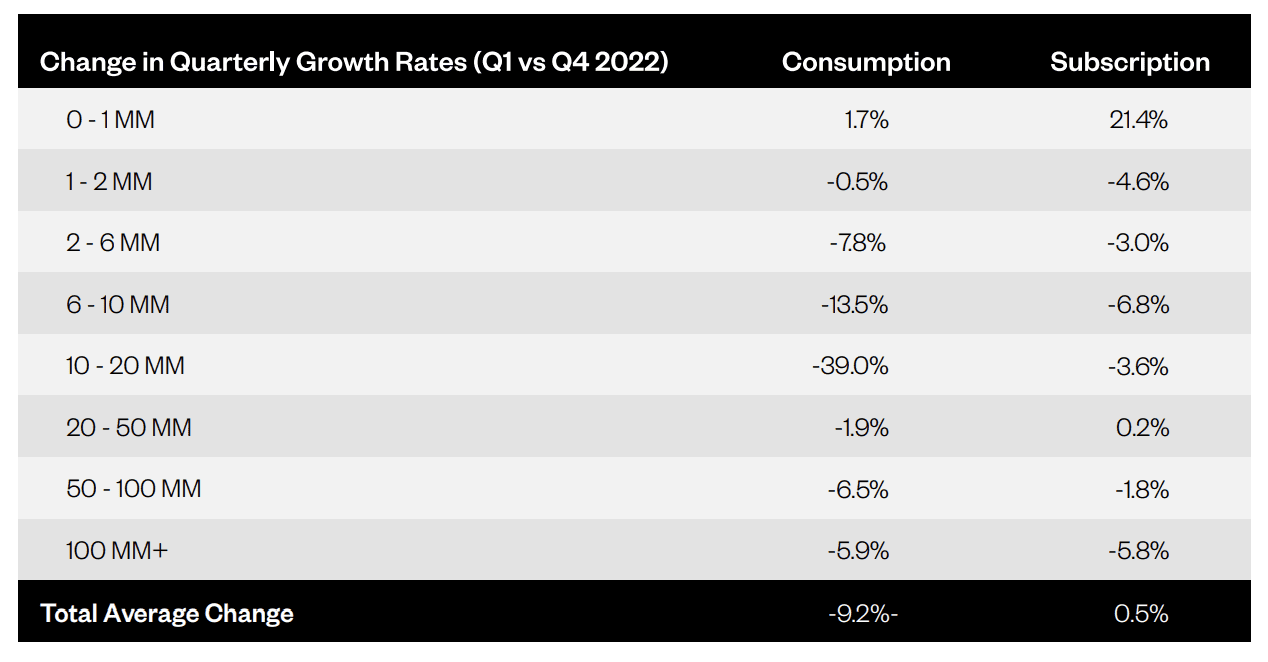

In 2022, SaaS companies’ growth rates were influenced by various pricing models to a significant extent. According to the report, companies that use consumption or usage-based pricing models – often associated with product-led growth (PLG) companies – experienced a more significant decline in growth rate, averaging 9.2% between 2021 and 2022. On the other hand, companies using subscription invoicing, which generally involves a more traditional high-touch sales-negotiated process, experienced a lower average decline of 0.5% during the same period.

SaaS companies using usage-based pricing can enjoy an immediate increase in monthly billings as customers grow and utilize the software more, as per the Maxio Growth Index report. However, these companies can also face a reduction in recurring billings when customer growth slows or reverses, which may come as a surprise. Conversely, companies using traditional subscription-based pricing models experience stability and predictability in their billings. However, they have limited opportunities for growth if customers expand their usage before the contract expires.

Impact of contract length on customer churn

The discrepancy between these pricing models is also impacted by the vendor agreement terms, according to the Maxio Growth Index report. The difference in growth rates between these groups is directly related to their agreement types. Companies using consumption-based pricing models often provide month-to-month agreements, while subscription-invoicing companies typically offer longer-term agreements of a year or more with predictable billing cycles. As the year progresses, companies with sales-negotiated contracts may experience additional churn as their customers approach renewal dates.

Other key findings of the Q1 2023 Growth Index report

The report indicates that mid-market self-service companies, which process $10-20MM in annual billing, experienced the most substantial growth decline between Q1 and Q4, with a 39% decrease. In contrast, contract-driven companies in the same cohort only experienced a decline of 3.6%. As businesses surpass the $1M revenue mark, they appear to become more resilient in the face of economic challenges. The analysis shows that around 82% of businesses above $1MM experienced YoY growth, compared to 67% when including the $1MM mark.

Source: Maxio

Read next: North American and European Companies to increase IT budgets by 51% in 2023