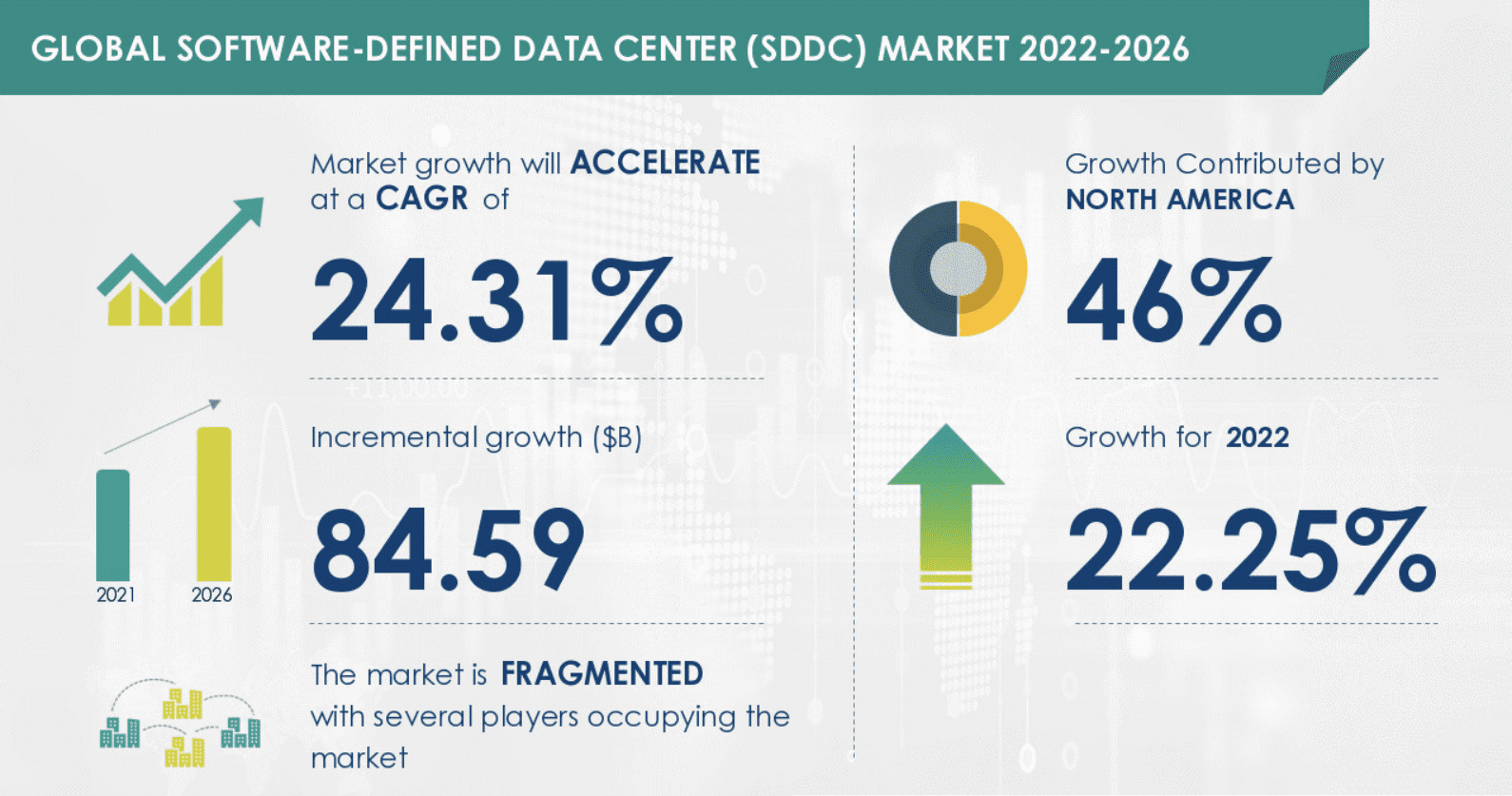

The latest research by Technavio forecasts that the software-defined data center (SDDC) market size is expected to grow by USD 84.59 billion from 2021 to 2026 at a CAGR of 24.31%.

46% of the market’s growth is expected to originate from North America during this period. The US is the key market for the SDDC market in North America. The rise in cloud adoption will facilitate the SDDC market growth in North America during the forecast period.

Hyperscalers and colocation data center providers are investing a lot of money in the data centers in North America to meet the increasing demand for cloud solutions and high bandwidth requirements. For example, in November 2021, T-Mobile entered into partnership with Qualcomm Technologies to drive the innovation of 5G in North America. Cyxtera Technologies Inc. (Cyxtera Technologies) expanded its data centers in five markets in North America in March 2019.

The advent of 5G services and the growing popularity of the Internet of Things (IoT) services are driving the data center bandwidth requirements in North America. This is expected to surge during the forecast period in the region. To cater to the growing demand from end-users for low-latency services, enterprises will continue to adopt SDDC solutions during the forecast period.

The COVID-19 pandemic boosted the SDDC market in North America in 2020. Businesses are adapting to a new work-from-home model, which is increasing demand for cloud services and digitization. Google invested more than $10 billion in offices and data centers across the US in February 2020. Initiatives like this by the key market players will drive the growth of the regional SDDC market during the forecast period.

SDS segment to be the significant revenue generator in SDDC market

In the SDDC market share, growth by the software-defined storage (SDS) segment will be significant for revenue generation. SDS solutions eliminate the dependency on storage hardware, thereby addressing the challenges involved in traditional storage systems.

- The entire storage system is managed and controlled by software in SDS with no dependence on the underlying hardware. It, therefore, overcomes the complexities in storage and vendor lock-in issues. SDS solutions enable enterprises to make use of their current storage systems. They also offer simplified data management, scalability, and transparency in storage availability. These factors are expected to drive the growth of the SDS segment during the forecast period.

- Some of the key customers for SDS include banks, hospitals, telecom companies, and businesses in the digital media industry. The digital media industry is growing quickly because of the increase in wired and wireless communication infrastructure and the growing number of people using mobile devices to connect to the internet.

- The end-users like the content and digital media, require highly efficient compute, storage, and network systems to provide enhanced services with low latency.

- Businesses are more careful about protecting data that is stored, processed, and used. SDDC solutions offer enhanced layers of security to make sure that data is protected and meets regulatory compliance requirements.

- The increasing data protection regulations and enterprises trying to reduce the operational complexity and costs by means of software-defined solutions and white-box products will increase the demand for SDS.

Major drivers for software-defined data center market growth

- The demand for data center modernization is growing, and this is one of the key reasons why the software-defined data center (SDDC) market is expanding.

- The use of artificial intelligence (AI), machine learning (ML), and deep learning (DL) is generating huge volumes of data that require efficient computing, storage, and network infrastructures. SDDC solutions are capable of handling heavy workloads by dynamic workload allocation to compute, storage, and network resources.

- SDDC vendors offer software-defined data center solutions to enterprises across industry verticals as per the business requirements. The global SDDC market is expected to witness significant demand during the forecast period, driven by the enterprises’ willingness to modernize their data centers due to the surge in the adoption of new technologies and the shift towards digital transformation.

Key trends in the SDDC Market

- AI is being used to improve the energy efficiency of data centers. By using AI, servers’ performance, power systems, and cooling systems can be computed. This is helping the growth of the software-defined data center market.

- AI is enabling faster decision-making and efficiency and offers data insights into the functions of internal systems. AI in data center automation software reduces human resources and facilitates energy-efficient operations.

- AI in data center automation processes facilitates the energy cooling process, with supervised control over mechanical cooling. This is achieved by making changes to the cooling process and using power effectively in the overall data center process.

AI technology is increasing performance and reducing downtime and human error. This will fuel the growth of the global SDDC market during the forecast period.

What are the software-defined data center market challenges?

- Cybersecurity problems are making it harder for the software-defined data center (SDDC) market to grow. Not complying with the General Data Protection Regulation (GDPR) can earn companies a fine of a maximum of 4% of their annual global revenue or $22.9 million.

- The popularity and demand for cryptocurrency are increasing, which makes it more likely that miners will hack into data centers.

- Distributed denials of service (DDoS) attacks on data centers have increased over recent years. In this type of cyberattack, hackers make data center resources unavailable to the end-users by continuously sending a lot of requests to the servers.

Factors like the above have a direct impact on business continuity and can slow down the growth of the global SDDC market during the forecast period.

Some of the key players in the SDDC market are Arista Networks Inc., AT and T Inc., Cisco Systems Inc., Citrix Systems Inc., Commvault Systems Inc., DataCore Software Corp., Dell Technologies Inc., EQT AB, Fujitsu Ltd., Hitachi Ltd., HP Inc., Huawei Investment and Holding Co. Ltd., International Business Machines Corp., Juniper Networks Inc., Lenovo Group Ltd., Microsoft Corp., Nokia Corp., Nutanix Inc., Oracle Corp., Scality Inc.

Get the complete report here.

Read next: NTT launches Edge-as-a-Service to speed up business process automation