The growth of global datacenter installed-base is expected to experience a decline of 0.1% CAGR during the forecast period (2019 to 2024), finds the leading tech analyst firm 451 Research.

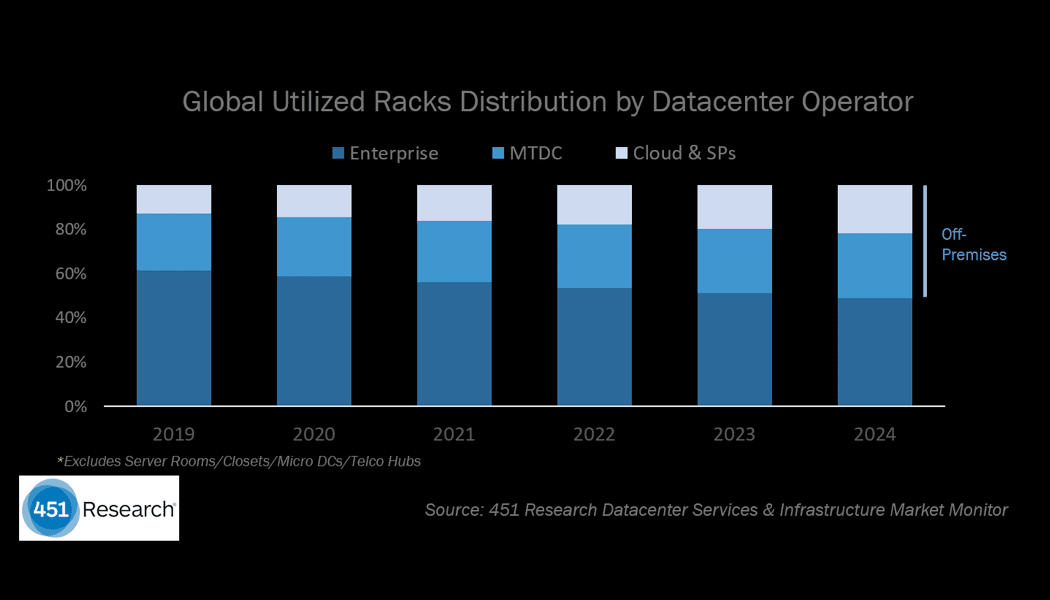

The new research, titled Datacenter Services and Infrastructure Market Monitor report, reveals that more than 50% of the utilized racks will be at off-premises facilities by 2024. The utilized racks don’t include server rooms, closets, micro datacenters, and telco hubs. The off-premised facilities include the cloud and colocation sites.

Despite the slight decline in growth of datacenter installed-base, the overall capacity (in terms of space, power, and racks) will rapidly rise. This is because more and more businesses are moving towards larger datacenters.

The research highlights that cloud and service providers are expected to drive the growth in datacenter capacity.

Related read: Interconnection and managed services necessary for datacenter providers to stay alive in cloud era: 451 research

“Across all owner types and geographic locations, cloud and service providers are driving expansion, with the hyperscalers representing the tip of the spear,” said Greg Zwakman, Vice President of Market and Competitive Intelligence at 451 Research.

“We expect to see a decline in utilized racks across the enterprise, with a mid-single-digit CAGR increase in non-cloud colocation, and cloud and service providers expanding their utilized footprint over 13%,” he added.

Server rooms and closets together hold a share of around 95% of the total datacenters. However, only the 23% of the racks has been utilized in 2019.

451 Research further indicates that 60% of the enterprise datacenter space is held by the datacenters that are smaller than 10,000 sq. ft.

The demand for datacenter racks will be significantly driven by IoT workloads and IoT data storage. As per the report, the growth will be around 46% during the forecast period. By the end of 2024, the IoT workloads and data storage will hold nearly 15% of the total datacenter racks worldwide.

The average size of a multi-tenant datacenter (MTDC) is around 9x larger as compared to an enterprise datacenter (not including the rooms/closets and micro DCs/telco hubs) in 2019.

451 Research also found that the top 6 hyperscalers around the world hold 42% of the total racks utilized by cloud and service providers in 2019. This will grow with a CAGR of 18% to reach 50.4% by 2024.

Also read: Legacy tools put organizations to survival mode rather than digital transformation: Forrester